2022 Industry Direction Report

2022 Automatic Identification and Data Capture Industry Direction Report

Featured Content in the Report:

- AIDC’s Place in Enterprise Technology Purchasing Plans & Priorities

- Drives and Obstacles for Planned Spending

- Leading Obstacles to Technology Investments

- Examining AIDC Provider Expectations

- Insights Into Leading Buyer Personas

- Bar Code Buyers

- RFID Buyers

- ERP Buyers

- IoT Buyers

- Manufacturers

- Logistics & Distribution Companions

Questions about purchasing the document?

Contact AIM at info@aimglobal.org or +1 724.742.4470

$2750

$3450

$5500

$6900

A preview of some of the insights from the report:

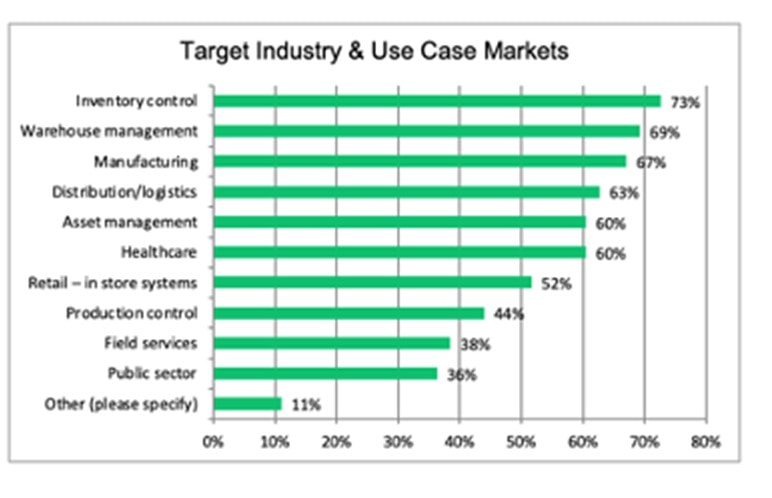

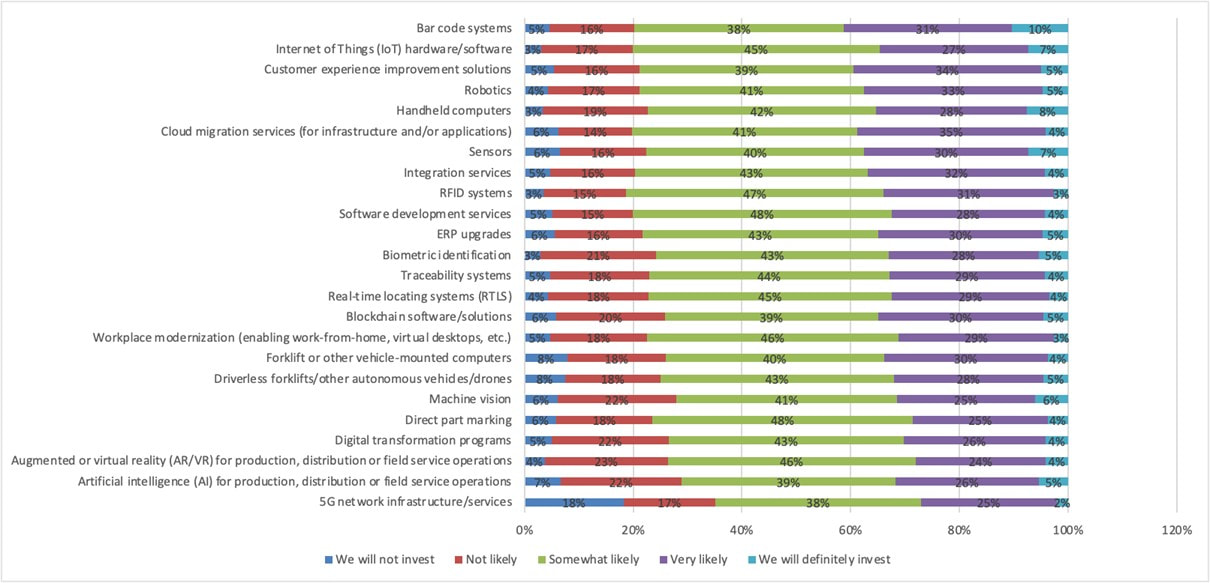

The AIM 2022 AIDC Industry Direction study found a positive sales climate for most AIDC product categories in 2023 – but also that AIDC is not a top purchasing priority. Only bar code systems ranked in the top 10 priorities among end users’ 27 technology investment areas.

- Investment priorities that ranked ahead of bar code systems and other AIDC categories include ERP upgrades, Internet of Things systems and workplace modernization programs. AIDC providers can increase their sales growth by demonstrating AIDC’s role and value in these and other higher-priority initiatives. IoT and ERP initiatives appear to be particularly strong catalysts and opportunities for complementary AIDC investments. The study found several disconnects between what AIDC end users and AIDC technology providers say is driving demand, and the demand for various product categories.

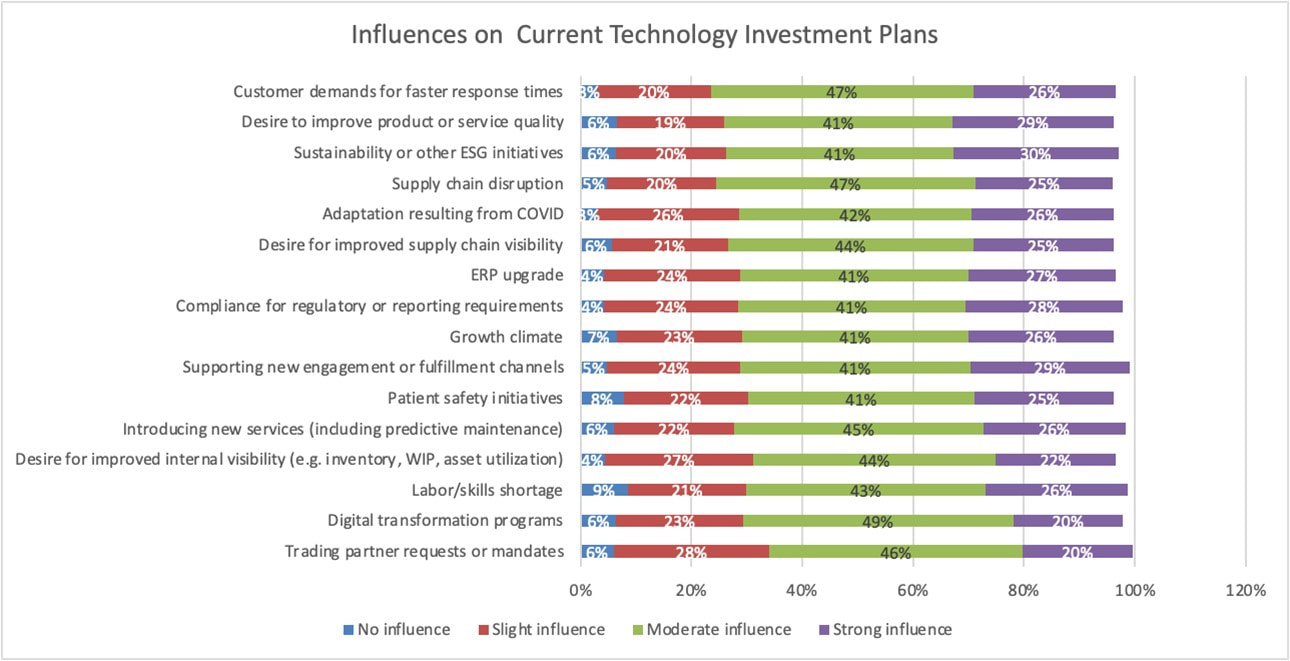

- At the macro level, the leading influences that are driving enterprise technology investment are improving response times to meet customer requirements, improving product or service quality, recovering from supply chain disruption and supporting enterprise sustainability goals.

- RTLS, RFID and biometrics all have relatively stronger growth potential than bar code systems according to end users’ 2023 purchasing intentions.

The full report includes data and analysis for purchasing intentions on 19 specific AIDC product categories, purchasing intention and enterprise priority data on 27 technology investment areas, AIDC professionals’ growth expectations for multiple AIDC products, use cases and industries, actual and perceived drivers behind technology investment plans, leading obstacles end users face in advancing projects, plus more detailed analysis of leading AIDC buyer roles.

Table of Contents

- About the Study

- AIDC’s Place in Enterprise Technology Purchasing Plans & Priorities

- Drives and Obstacles for Planned Spending

- Leading Obstacles to Technology Investments

- Examining AIDC Provider Expectations

- Insights Into Leading Buyer Personas

- Bar Code Buyers

- RFID Buyers

- ERP Buyers

- IoT Buyers

- Manufacturers

- Logistics & Distribution Companions

- Conclusion

Charts

- Top 10 Technology Investment Priorities Through 2023 for AIDC Users & Prospects Surveyed

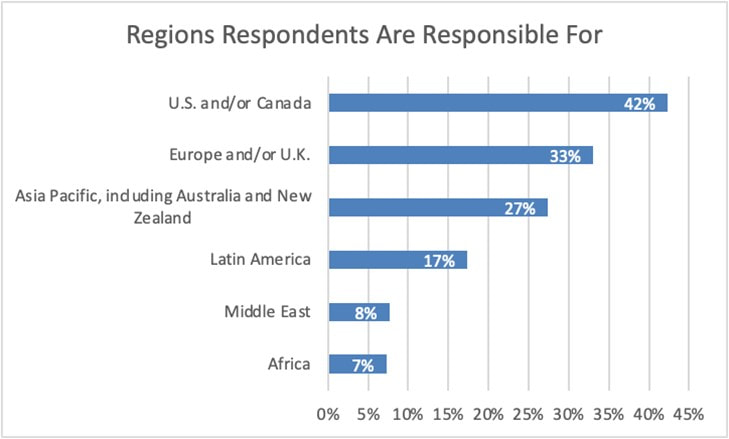

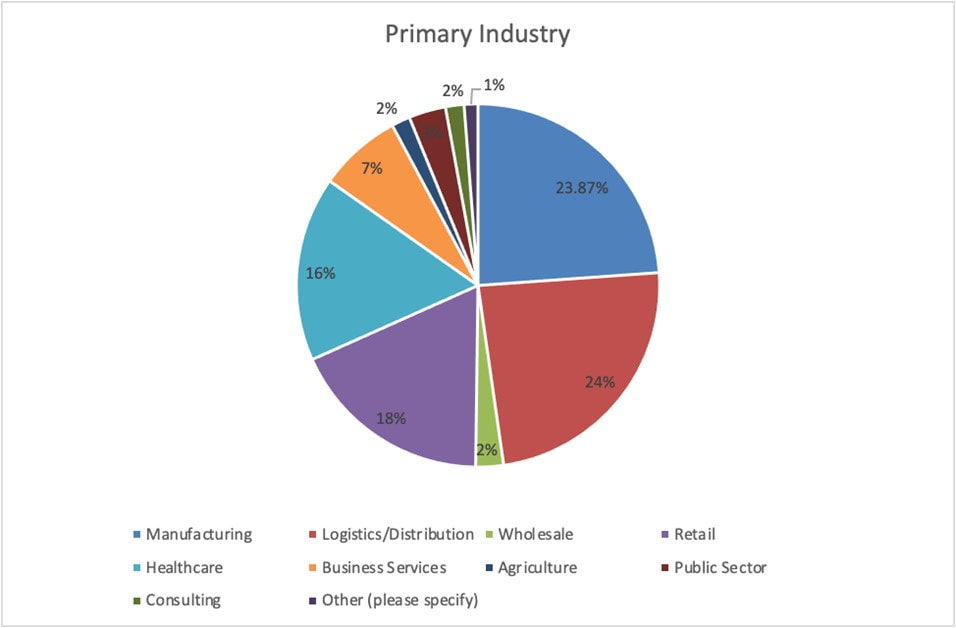

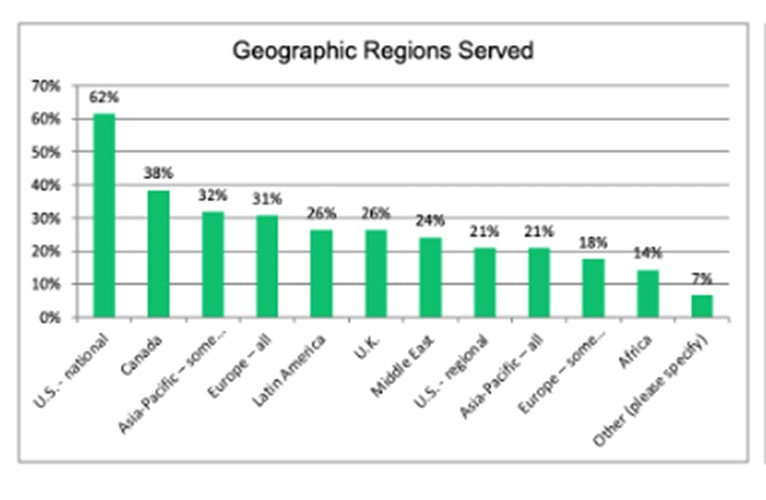

- Select Demographic Data for AIDC Industry Respondents

- End User Purchasing Intentions Through 2023, Ranked

- Expected Changes in AIDC Investment Levels 2022-23, Ranked

- End Users’ Spending Plans vs. AIDC Professionals’ Spending Expectations

- Enterprise Technology Investment Priorities Through 2023, Ranked

- Influences on Enterprise Technology Investment Plans, Ranked

- Select Comparison of End User and AIDC Perceptions of End Users’ Technology Investment Influences

- End Users’ Leading Obstacles to Technology Investments, Ranked

- AIDC Provider Perceptions of Negative Influences on Enterprise Technology Investment, Ranked

- AIDC Provider Expectations for Hardware, Software & Services Demand, Ranked

- AIDC Provider Demand Growth Expectations for Environments and Use Cases, Ranked

- AIDC Sales Threats by Competitor Category, Ranked

- Interest Level in Pursuing New Partner/Reseller Relationships for Various Vendor Categories, Ranked

- What Influences Technology Investment by Bar Code Buyers?

- What Else Are Bar Code Buyers Buying? – Top 15 Areas for Investment

- Top 10* Investment Priorities for Bar Code Buyers

- Bar Code Buyers’ Expected Changes in AIDC Investment Through 2023

- Company Types that Bar Code Buyers Expect to Purchase From

- Obstacles to Investing in Bar Coding

- What Influences Technology Investment by RFID Buyers?

- What Else Are RFID Buyers Buying?

- RFID Buyers’ Expected Changes in AIDC Investment Through 2023, Ranked

- Top 15 Investment Priorities for RFID Buyers, Ranked

- Obstacles to Investing in RFID, Ranked

- Top 15 Technologies ERP Buyers Are Investing In, Ranked

- AIDC Purchasing Intentions Among ERP Buyers, Ranked

- Top 15 Purchasing Priorities Among Enterprises Undergoing ERP Upgrades

- Top 10 Technology Investment Influences for Enterprises Undergoing ERP Upgrades

- Top 15 Technology Investment Priorities for IoT Buyers

- Expected AIDC Demand Change Among IoT Buyers, Ranked

- Manufacturing Respondents by Industry Subcategory

- Top 15 Purchasing Intentions for Manufacturers Through 2023, Ranked

- Top 15 Purchasing Priorities for Manufacturers

- Manufacturers’ Expectations for AIDC Investment Changes Through 2023, Ranked

- Influence of Trading Partner Requests/Mandates on Technology Investment Plans

- Technology Investment Influences on Manufacturers, Ranked

- Top 15 Purchasing Priorities for Logistics & Distribution Companies Through 2023, Ranked

- What are Logistics & Distribution Companies Buying?

- Logistics & Distribution Companies’ Expectations for AIDC Investment Changes Through 2023, Ranked

- Influences on Logistics & Distribution Companies’ Technology Investment Plans, Ranked

- Likelihood to Invest in Driverless Forklifts, Other Autonomous Vehicles or Drones

- Lack of Standards as an Obstacle to Making Desired Technology Investments

Questions about purchasing the document?

Contact AIM at info@aimglobal.org or +1 724.742.4470